When upgrading to Rank Math PRO, you may have realized that your purchase may be subject to select taxes (depending on your location), such as Value-Added Tax (VAT) and/or Goods and Services Tax (GST).

Common questions include:

- “I am from the UK, why am I paying tax?”

- “I’m from a tax haven, why am I paying tax?”

- “I’m from a different country than yours, why am I paying tax?”

- “I’m exempt from paying tax, why are you charging me GST/VAT?”

- “I have a VAT/GST ID, why am I still subject to GST/VAT?”

In case you’re wondering why this is the case, let’s clear that up.

We’ve partnered with FastSpring, a global full-service SaaS payments platform. The FastSpring platform includes a tax service that provides accurate tax rates to our customers in real-time. Therefore, the applicable taxes are automatically applied during the checkout process based on location and product type (not by us). FastSpring then proceeds to collect, file, and remit the payment on Rank Math’s behalf.

If you are considered exempt from paying taxes, you can claim a refund after completing your purchase. This is extremely easy to do & can be done by contacting FastSpring’s consumer support here.

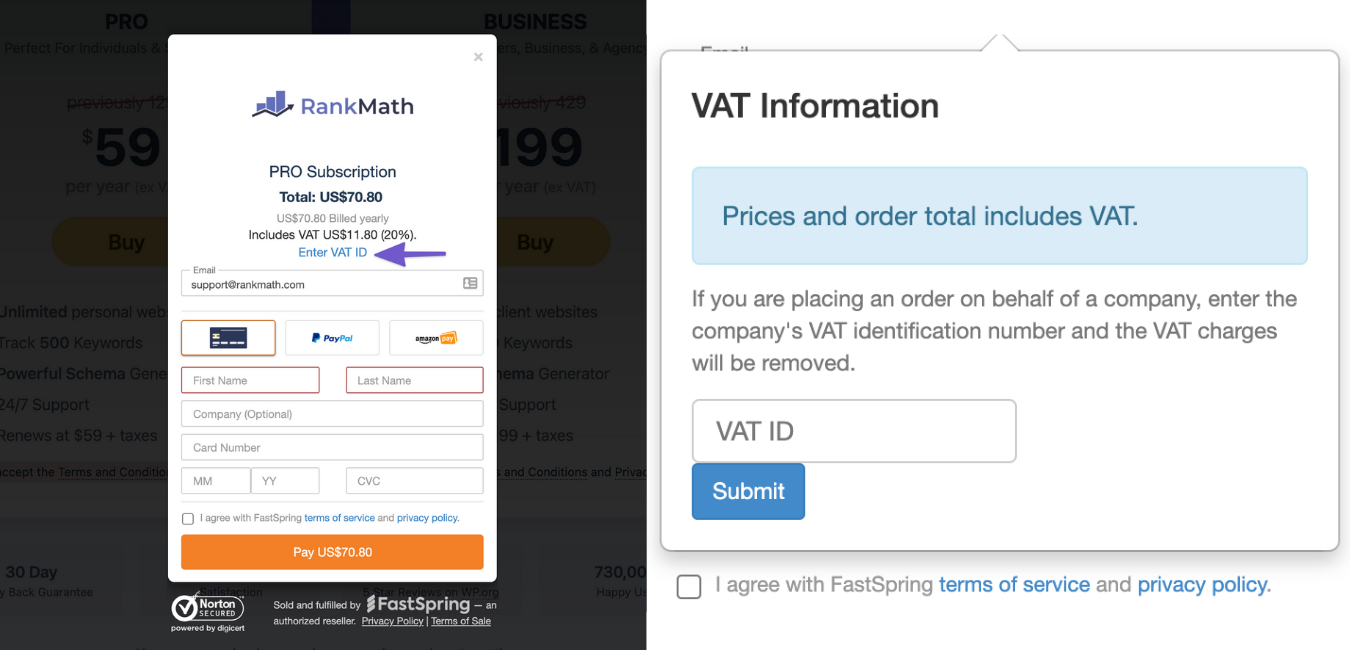

To make it easier, you can also already add your VAT identification number during the checkout process as shown below:

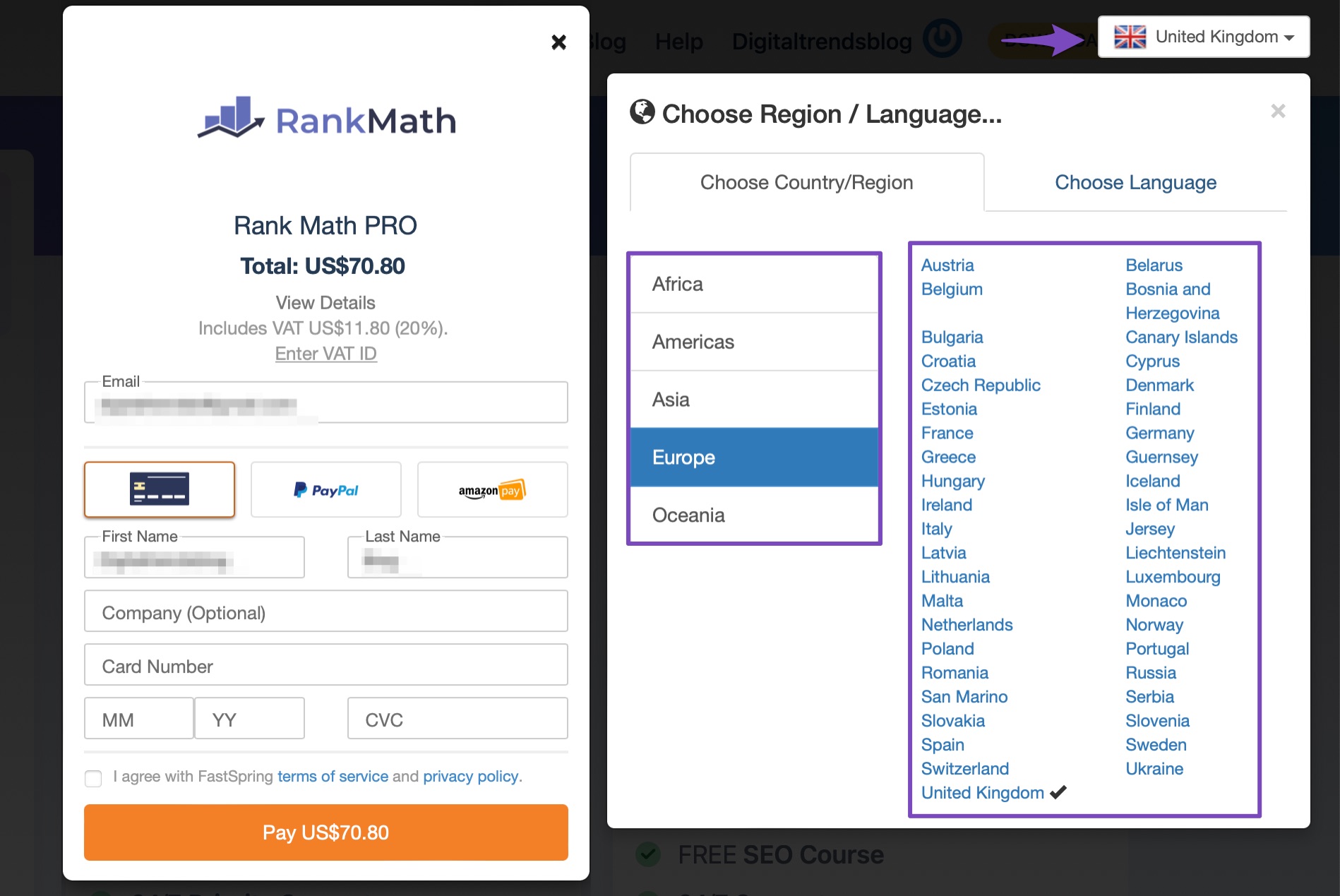

If the option to enter your VAT ID is not displayed or you receive an error message after submitting your VAT ID, you should disable any Proxy or VPN service on your computer. Once done, navigate to the top-right corner of the checkout page and click the Region / Language dropdown menu. Then, select the region and country where the business is registered. Once done, enter your VAT ID again.

Many companies choose to rely on globally recognized payments partner like FastSpring to handle the complex process associated with handling payments (such as collecting tax in every country) at scale. That way, the lengthy process of registering to collect tax in every country can be left to the company that’s dedicated & specialized to be the best at handling that – letting us spend more time focusing on our product.